Which Statement Best Describes an Adjustable Rate Mortgage

The rule of law ensures that leaders can only exercise the powers the people give them. With an ARM the interest rate and monthly payment may start out low.

This is typical of many adjustable-rate mortgages ARMs.

. With an adjustable rate mortgage if the rate of inflation jumps then the nominal rate on the mortgage will For each item listed below indicate in the space to the right whether the item would be considered a product cost or a period cost for a manufacturin. Which of the following statements best describes the impact of a rate cap on an adjustable rate mortgage ARM. 5 Questions to Help You Decide Looking for the right type of loan.

They generally carry higher initial interest rates than conventional mortgages. Which of the following statements is true of adjustable-rate mortgages. This act added familial status and disability both physical and mental to the existing federally protected classes.

If interest rates were to rise on a level-payment mortgage LPM the interest rate risk of the loan would typically be borne by. The house the borrowers car the borrowers income tax refund nothing 3With an Adjustable Rate Mortgage ARM the interest rate paid over the life of the loan will _____. An adjustable rate mortgage is also popularly known as the valuable rate mortgage or the floating rate mortgage.

How to File Your Return With Form 1098 for Mortgage Interest. When a lender offers a loan to a buyer for a house _____. There is no limit as the amount of payment change on an ARM.

Fixed rate mortgages can come in different term lengths. If youre ready to file taxes with a Form 1098 Mortgage Interest Statement the easiest way to do it is to use an online tax prep. Margo is in the ownership stage of the property ownership lifecycle.

When rates go up ARM borrowers can. The interest rate changes on ARMs are limited per year and per lifetime. The rule of law requires direct democracies to introduce representative government.

Adjustable-rate mortgages are often paired with borrowers who only plan on staying in their home for less than 10 years on average says Jason Sorochinsky vice president of mortgage lending. One reason why adjustable-rate mortgages ARMs have become popular has to do with the impact that they have on the interest rate risk that is borne by the parties involved. B Real interest rates can decline only to zero.

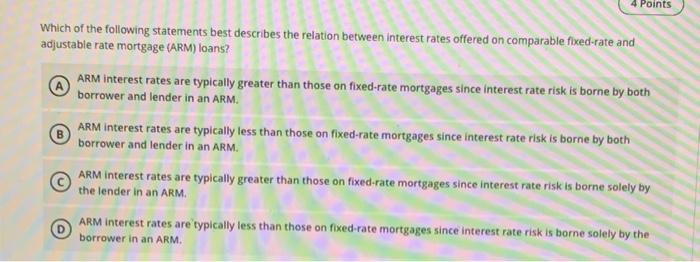

Which of the following statements best describes the relation between interest rates offered on comparable fixed-rate and adjustable rate mortgage ARM loans. A rate cap decreases the overall level of interest rate risk exposure on the mortgage loan for both borrower and. The intentional omission of relevant information can be considered an act of mortgage fraud.

All of the following statements correctly describe mortgage fraud EXCEPT. ARM interest rates are typically greater than those on fixed-rate mortgages since interest rate risk is borne by both borrower and lender in an ARM. An ARM is a mortgage with an interest rate that changes or adjusts throughout the loan.

Consider an ARM only if you can afford increases in your monthly paymenteven to the maximum amount. Select the statement about this deduction thats true. As opposed to a fixed-rate home mortgage an adjustable rate home mortgage is not confined to the single interest rate that is adhered to by a fixed interest mortgage.

To illustrate imagine someone takes out a 250000 mortgage with a 30-year term and a 45 interest rate. They cannot be converted to fixed-rate loans. One reason why adjustable-rate mortgages ARMs have become popular has to do with the impact that they have on the interest rate risk that is borne by the parties involved.

An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. Fixed-Rate Mortgage or Adjustable Rate Mortgage. If interest rates were to rise on a level-payment mortgage LPM the interest rate risk of the loan would typically be borne by.

PLEASE EXPLAIN A Real interest rates exceed inflation rates. Which statement best describes the relationship between the rule of law and democratic forms of government. ARMs generally have caps.

A rate cap increases the overall level of interest rate risk exposure on the mortgage loan for both borrower and lender. C Real interest rates can be negative zero or positive. ___ serves as collateral for the loan.

Mortgage fraud can occur without the knowledge or active participation of the borrower. Deciding on the type of loan that fits your financial situation can be a difficult decision. Which of the following statements best describes the real interest rate.

However both the rate and the payment can increase very quickly. This type of mortgage is characterized by which the interest rate that will be paid will differ based on a. The rule of law allows elected officials to issue extremely harsh.

The normal ARM is changed once a year based on interest rates particularly. The borrower only B. The fair housing amendment.

Only lenders can be investigated or found guilty of mortgage fraud. An adjustable-rate mortgage ARM is a home loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark. Adjustable rate mortgages or ARMs as it is abbreviated have the payments due to the most cases a bank fluctuate.

For All Borrowers Adjustable Rate Mortgages Home Mortgage Consumer Protection

What Best Determines Whether A Borrower S Investment On An Adjustable Rate Loan Goes Up Or Down Global Investor Network

Cordless Stick Vacuum Cleaner Lightweight 17kpa Powerful Suction Bagless Rechargeable 2 In 1 Handheld Car Vacuum With Fha Loans Fha 203k Loan Renovation Loans

Refinance Processchris Dyer Chris Dyer Refined The Unit Home Decor Decals

Find The Best Mortgage Loan To Meet Your Home Loan Needs Refinance Mortgage Refinancing Mortgage Mortgage Loans

Solved 4 Points A Which Of The Following Statements Best Chegg Com

History Of Cryptocurrency Cryptocurrency Investing History

Having A Child Changes Your Life Forever It S A Huge Decision This Totally Describes The Scariest Pa Single Mom Life Homemade Pumpkin Spice Single Motherhood

Adjustable Rate Mortgage Guide Pros And Cons Debt Com

Fixed Rate Vs Adjustable Rate Mortgages

Fixed Rate Vs Adjustable Rate Mortgage Which Is Right For You Bree Associates

F Cking Barclays A Creative Hijack Of A Disgraced Brand Co Create Creativity Culture Commerce Bank Ad Barclay Mortgage Help

Fixed Rate Vs Adjustable Rate Mortgage Which Is Right For You Bree Associates

Fixed Or Adjustable Rate Mortgages Understanding Home Loan Choices Sofi Home Improvement Loans Home Home Loans

The Zero Rate Conundrum Does It Really Make Sense Ishares 20 Year Treasury Bond Etf Nasdaq Tlt Seeking Alpha Developed Economy Nasdaq Ishares

/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

Fixed Rate Vs Adjustable Rate Mortgage Which Is Right For You Sanders Team Realty

Comments

Post a Comment